With the ever-evolving landscape of business operations, it’s becoming increasingly important for organizations to maintain accurate and efficient expense tracking systems. Understanding which expenses are eligible for reimbursement or tax deductions is crucial for ensuring both compliance and financial stability. One common question that arises in this context is: “Which expenses do not qualify as expense accounts?” To navigate these complex regulations, it’s essential to delve into the intricacies of business accounting practices.

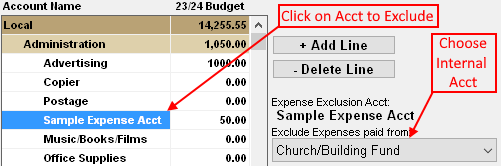

Image: ntssoftware.com

Expense accounts are designed to record and track expenses incurred by employees or authorized personnel for business purposes. These expenses are typically categorized and recorded in specific accounting ledgers, and may provide tax benefits or reimbursement opportunities. However, certain expenses fall outside the scope of expense accounts due to their nature or specific regulations. Identifying and distinguishing these non-qualifying expenses is paramount for proper financial management.

Non-Reimbursable and Non-Deductible Expenses

Personal Expenses: Personal expenses, such as commuting to and from work, meals unrelated to business travel, and entertainment solely for personal enjoyment, are not eligible for expense reimbursement or tax deductions. These expenses are considered personal in nature and fall outside the purview of business operations.

Capital Expenditures: Capital expenditures, which represent long-term investments in assets such as property, equipment, or major renovations, are not expensed in the same way as other operating expenses. Instead, they are capitalized and depreciated over time, providing a tax benefit in the form of reduced taxable income.

Expenses Related to Illegal Activities: Expenses incurred in connection with illegal activities, such as bribes, kickbacks, or fines, are not considered legitimate business expenses and are not eligible for reimbursement or tax deductions. These expenses are not only unethical but may also have serious legal consequences.

Political Contributions: Political contributions and lobbying expenses are not deductible for federal income tax purposes. Such expenses are deemed unrelated to the ordinary course of business and therefore lack the necessary business purpose for tax deductions.

Fines and Penalties: Fines and penalties imposed by government agencies or courts as a result of violations or non-compliance are non-deductible expenses. These costs are considered a form of punishment and are not related to business operations.

Taxes: Taxes, including income taxes, property taxes, and sales taxes, are not generally deductible for business entities. These payments are considered obligations to the government and are not eligible for reimbursement or tax deductions.

Entertainment Expenses: Business entertainment expenses, such as meals and events primarily intended to entertain clients or customers, are subject to specific limitations and rules. To qualify for deduction, these expenses must satisfy certain criteria, including being directly related to business activities and serving a clear business purpose.

Advance Planning and Proper Documentation

To ensure compliance with tax regulations and avoid potential financial penalties, it’s imperative for organizations to establish clear expense policies and provide adequate training for employees. Understanding which expenses qualify as expense accounts is essential, and careful record-keeping is vital to substantiate all expenses claimed for reimbursement or tax deductions.

Proper documentation is crucial in supporting business expenses. Receipts, invoices, and detailed records should be maintained to provide evidence of the nature and purpose of the expenses. This documentation serves as the basis for review and approval by management and accounting personnel, and also protects the organization in the event of an audit or inquiries from tax authorities.

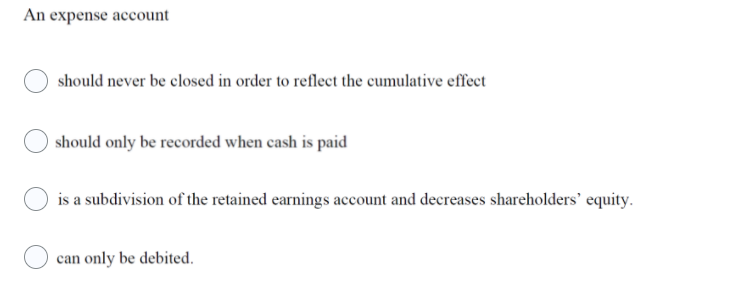

Image: www.chegg.com

Which Is Not A N Expense Account

https://youtube.com/watch?v=g1n6eA5noJ0

Conclusion

Identifying which expenses are not eligible for expense accounts is an important aspect of business accounting. By understanding the nature and classification of personal expenses, capital expenditures, illegal activity-related expenses, political contributions, fines and penalties, taxes, and entertainment expenses, organizations can ensure accurate financial reporting, compliance with tax regulations, and responsible use of company funds. Clear policies, comprehensive training, and meticulous record-keeping are essential for effective expense management and the preservation of financial integrity.