In the realm of business finance, understanding the sources of a company’s worth is crucial for investors, analysts, and entrepreneurs alike. Stockholders’ equity, representing the value of ownership in a company, holds special significance as it reflects the residual claim of investors on the company’s assets after considering its liabilities. However, it is essential to recognize that stockholders’ equity is not a static concept; rather, it is derived from two primary sources that shape the company’s financial structure and value proposition.

Image: zuoti.pro

1. Capital Contributions: The Foundation of Ownership

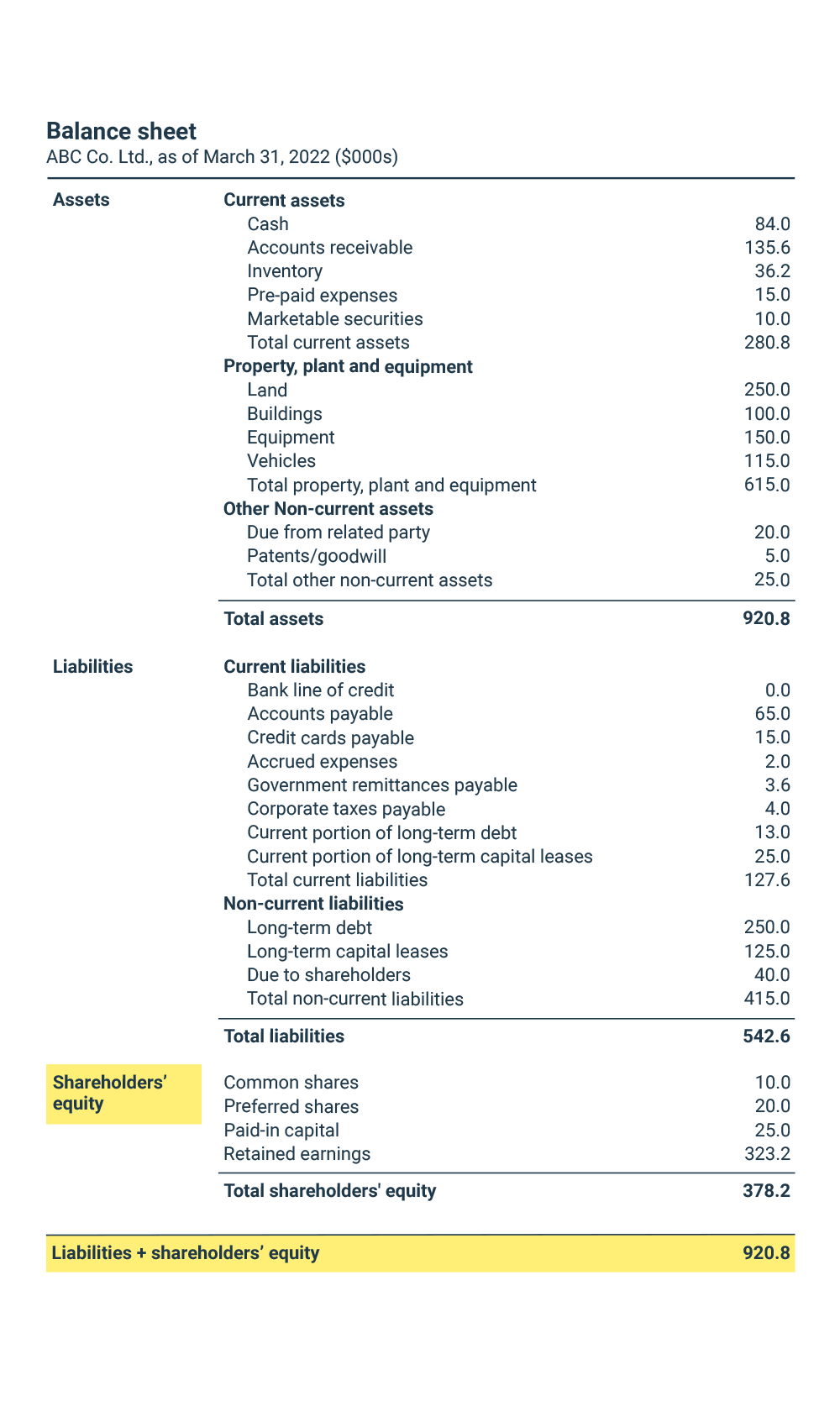

The initial source of stockholders’ equity stems from the capital contributed by investors at the time of the company’s formation. These contributions, known as capital stock, represent the price paid by investors in exchange for a proportionate share of the company’s ownership. Notably, capital stock can take various forms, including common stock, which carries voting rights, and preferred stock, which typically offers fixed dividends but limited voting power.

Capital contributions serve as the cornerstone of a company’s financial resources, providing the necessary funds to establish operations, acquire assets, and commence business activities. Additionally, these contributions reflect the confidence and trust of investors in the company’s prospects and growth potential.

2. Retained Earnings: Accumulating Value Over Time

While capital contributions provide the initial base of stockholders’ equity, retained earnings contribute to its ongoing growth and sustainability. Retained earnings represent the portion of a company’s profits that is reinvested back into the business instead of being distributed as dividends to shareholders. This reinvestment can take different forms, such as capital projects, research and development, or debt reduction.

Retained earnings are vital for a company’s long-term growth and financial stability. By reinvesting profits, companies can expand their operations, enhance their competitive advantage, and increase their earning potential. This cumulative effect of retained earnings ultimately translates into enhanced value for stockholders, as the company’s earnings and assets grow over time.

Image: woskevindyer.blogspot.com

The Two Sources Of Stockholders’ Equity Are Amounts

Conclusion

The two sources of stockholders’ equity, capital contributions, and retained earnings, constitute the building blocks of a company’s financial structure. Understanding these sources is not only essential for financial analysis and investment decisions but also provides insights into the company’s growth trajectory, financial discipline, and overall health. By leveraging these sources effectively, companies can solidify their value proposition, enhance returns for shareholders, and establish a solid foundation for sustainable growth.