In an interconnected global financial system, economies are intricately linked, influencing each other’s economic health and performance. Understanding these linkages is crucial for formulating sound economic policies. One fundamental concept in open economy macroeconomics is the relationship between national saving and its components, which sheds light on a country’s financial position vis-à-vis the rest of the world.

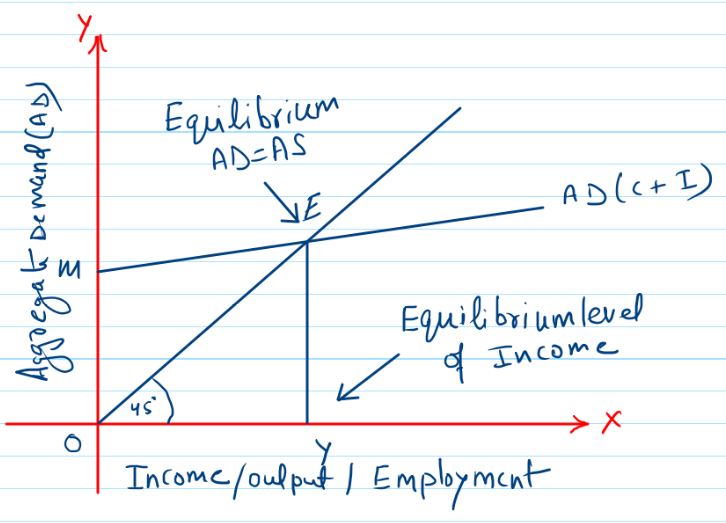

Image: commerceschool.in

Defining National Saving

National saving, a measure of an economy’s thriftiness or propensity to save, encompasses all saving decisions made within a country during a specific period, typically a year. It comprises three main components: private saving, government saving, and net foreign investment.

Private saving refers to the saving choices of households and businesses. Households save a portion of their disposable income for future needs or investments, while businesses save their retained earnings for expansion, innovation, or investment.

Government saving, also known as the public saving, represents the surplus or deficit of the government budget. When the government’s revenue exceeds its expenditure, it generates a positive government saving. However, if the government spends more than it collects in tax revenue, it incurs a public sector deficit or negative saving.

National Saving and the Balance of Payments

In an open economy context, national saving doesn’t just represent domestic saving behavior; it also has implications for a country’s balance of payments. The balance of payments is a record of all economic transactions between a country and the rest of the world over a given period. It consists of the current account and the capital and financial account.

The current account, which primarily captures the flow of goods, services, and income across borders, is influenced by national saving. When domestic saving exceeds domestic investment, a country exports more than it imports, resulting in a current account surplus. Conversely, when domestic investment exceeds domestic saving, a country must borrow from abroad to finance its spending, leading to a current account deficit.

The capital and financial account records the flow of financial assets between a country and the rest of the world. This includes foreign direct investment, portfolio investment, and foreign exchange reserves. The capital and financial account balance is the counterpart to the current account balance, ensuring equilibrium in the overall balance of payments.

Government Policy Implications

Understanding the interplay between national saving and external accounts is crucial for policymakers. Governments can adopt various fiscal and monetary policies to influence private and public saving decisions, which in turn affect the current account balance. For example, a government may implement tax incentives to encourage household saving or introduce austerity measures to reduce budget deficits, thereby increasing national saving.

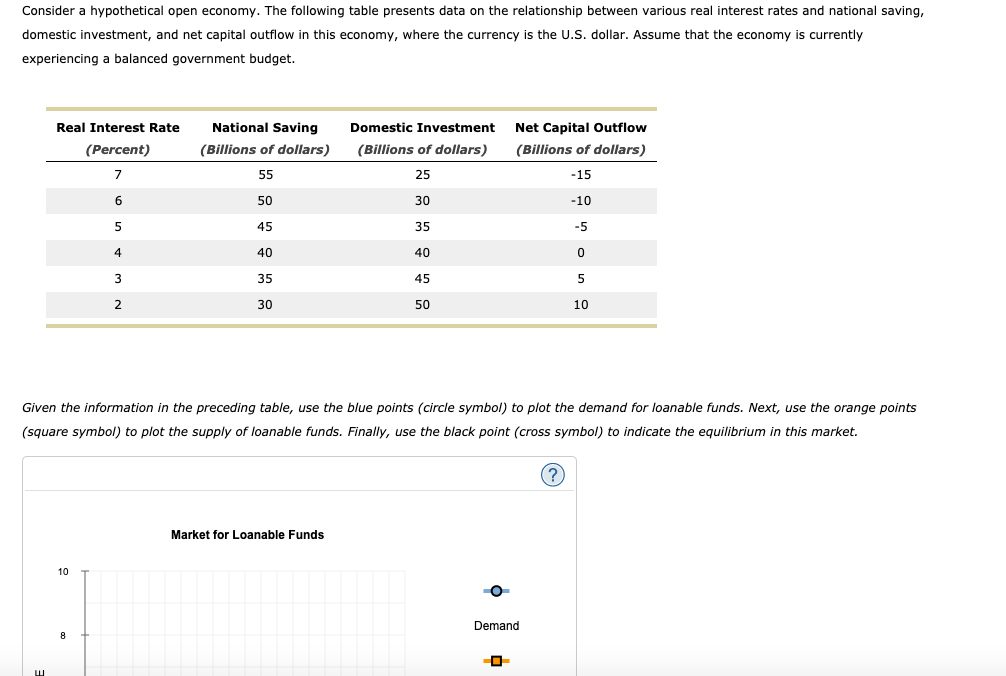

Similarly, monetary policy tools, such as interest rate adjustments, can incentivize or discourage investment and saving behavior. By lowering interest rates, a central bank can make borrowing more accessible, potentially boosting investment and reducing saving. Conversely, raising interest rates can make borrowing more expensive, encouraging saving and dampening investment.

Image: www.chegg.com

In An Open Economy National Saving Equals

Conclusion

In an open economy, national saving embodies the economic decisions made by households, businesses, and the government. It plays a critical role in shaping a country’s balance of payments, influencing its current account and capital and financial account. Governments can leverage fiscal and monetary policies to influence national saving and external accounts, seeking a balance between economic growth, external stability, and domestic financial health.